In the simplest terms, new business development research can be summarized as the ideas, initiatives, and activities that help make a business better. This includes increasing revenues, growth in terms of business expansion, increasing profitability by building strategic partnerships and making strategic business decisions.

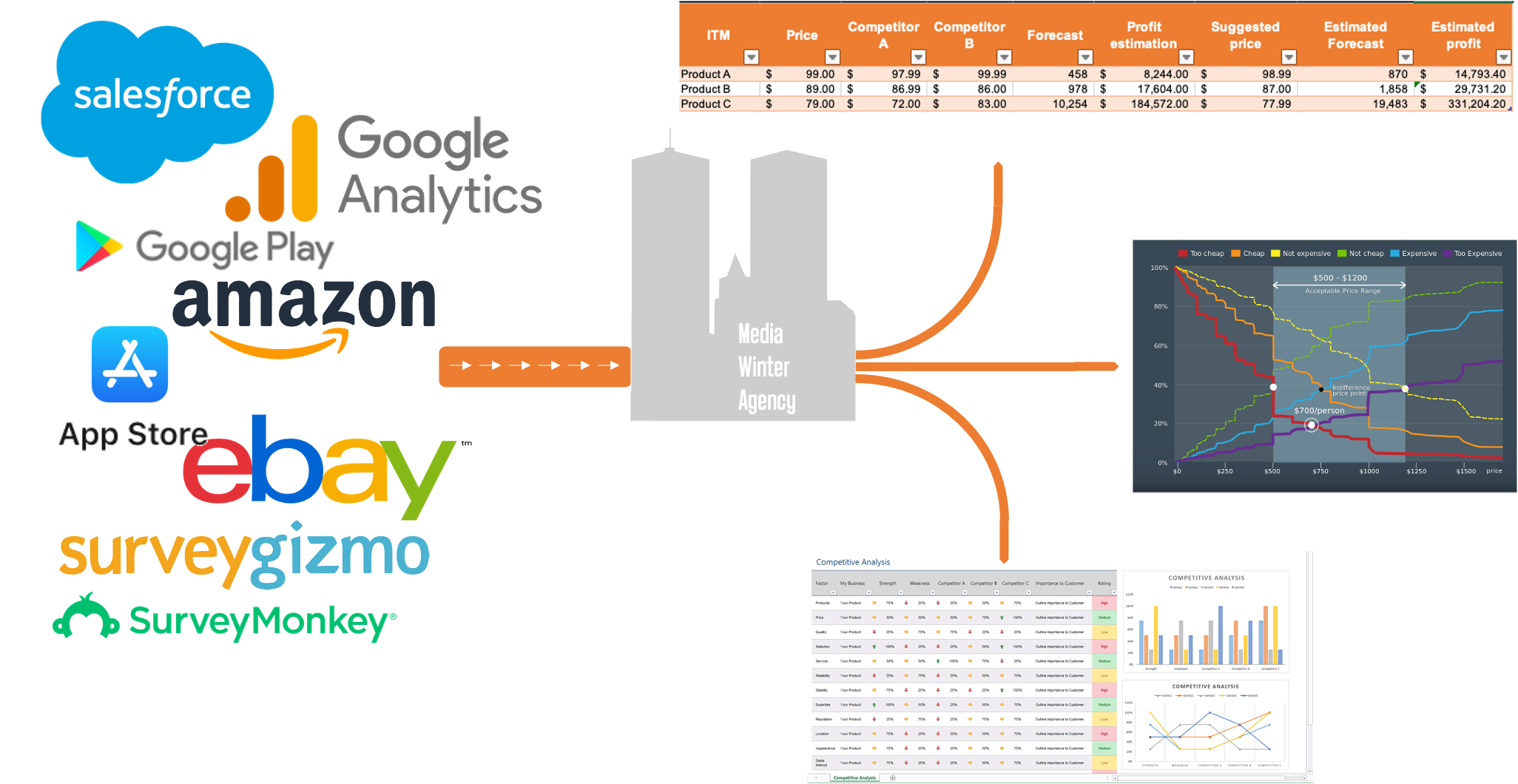

Pricing:

When the question is purely one of pricing, we use two standard pricing techniques: The Gabor-Granger series and the Van Westendorp Price Sensitivity Meter. The data from these techniques can be used to plot demand curves, calculate price elasticity, and identify optimal price points and ranges.

New Market Validation

Our qual-quant-qual approach to new market research helps you launch with confidence and spot fresh opportunities for your business. Our partnerships with accelerators give us a wide array of experience conducting research for startups, including:

• Deep Interviews

• Ethnography (can be done virtually!)

• Mobile Diary Studies

• Persona & Journey Mapping Research

Product Research

Validate your product direction and avoid rollout disasters through feedback direct from customers. Techniques include:

• Agile/Lean Testing

• Rapid Prototyping & Iterative Testing

• Heuristic Evaluations

Customer Interviews + Surveys

By far our most popular offering, we recruit and conduct in-depth interviews with your audience, offering you clarity and confidence to make decisions about your brand or products. After making hypotheses about your customers, we conduct a large-scale survey to make sure our assumptions scale across a large population. Inevitably, we learn things during the survey we want to dive into, so we schedule interviews post-survey as well to deep dive into specific insights.